40+ mortgage self employed less than 1 year

Ad 5 Best House Loan Lenders Compared Reviewed. Seller concessions to 6 2 for investment Minimum Loan.

Self Employed Mortgage Loan Requirements 2023

A FICO score of 640 or higher Income that does not exceed 115 of your areas median income No down payment required VA loans.

. If youve been out of work for more than 6 months you need to be employed. Web How to get Approved for a Mortgage if Youve Been Self-Employed Less than 1 Year For this type of scenario youll need to get a no income verification. 4 years seasoning for foreclosure short sale bankruptcy or deed-in-lieu.

Take Advantage And Lock In A Great Rate. Looking For a House Loan. Web A few basic requirements for the non-QM loan program for self-employed borrowers.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. In the past it was impossible for self-employed applicants to be approved for a mortgage without at least one years worth of accounts. Web Self- employed applicants must prove that they have stability in employment and income and the standard requirement is about two years with.

Web Today we cover exactly how to get approved for a mortgage if you have been self employed for less than 1 year. Web Getting a mortgage with less than one years worth of accounts. Web Borrowers with only one year of self-employment history can get approved by showing they were employed in a similar field for at least two years before their self-employment started.

Web Length of Self-Employment. Web You shouldnt wait until the end of the year to pay your self-employment tax and income tax on your business income or else you might owe interest and penalties. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

However a person who has a shorter history of self-employment 12 to 24 months may be considered as long as the. Compare Lenders And Find Out Which One Suits You Best. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web 51 ARM or 30-year fixed. Get The Answers You Need Here. Fannie Mae generally requires lenders to obtain a two-year history of the borrowers prior earnings as a means of demonstrating the likelihood that the income will continue to be received.

This is making it easier for these applicants to qualify. Well Help You Estimate Your Monthly Payment. Looking For a House Loan.

Ad 5 Best House Loan Lenders Compared Reviewed. Compare Apply Directly Online. This is because lenders needed to provide physical evidence theyd lent responsibly.

But the good news is that many lenders are loosening their requirements. Web Mortgage loan requirements for self-employed borrowers Most mortgage lenders require at least two years of steady self-employment before you can qualify for a. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

A traditional loan will not be an option if you have been. Ad Compare Home Financing Options Online Get Quotes. Use NerdWallet Reviews To Research Lenders.

Web Getting a mortgage as a self-employed borrower can be challenging. Comparisons Trusted by 55000000. Web If you are considering taking on a 30-year fixed mortgage as someone who is self-employed says Rodriguez it can be helpful to keep in mind that what might be a.

Credit scores of 620 or higher. 620 score requires a 15 down payment 660 or higher only need a 10 down payment 30-day mortgage late payments allowed May require four months of reserves Reserves are strong compensating factors on non-QM. Web 1 ranked lender in Minnesota - 4795 contributions Lenders do a two-year look back.

Compare Lenders And Find Out Which One Suits You Best. It Only Takes Minutes to See What You Qualify For. Need To Know How Much You Can Afford.

Comparisons Trusted by 55000000.

Choosing Between A 4 Or 5 Year Fixed Mortgage Best Mortgage Broker Rates

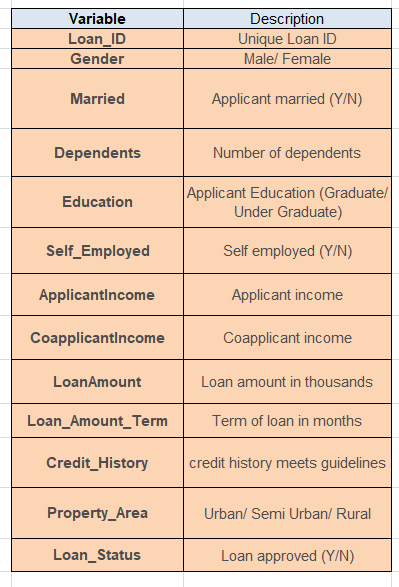

Case Study Loan Prediction Loan Prediction From Start To End By Vishnu Vardhan Medium

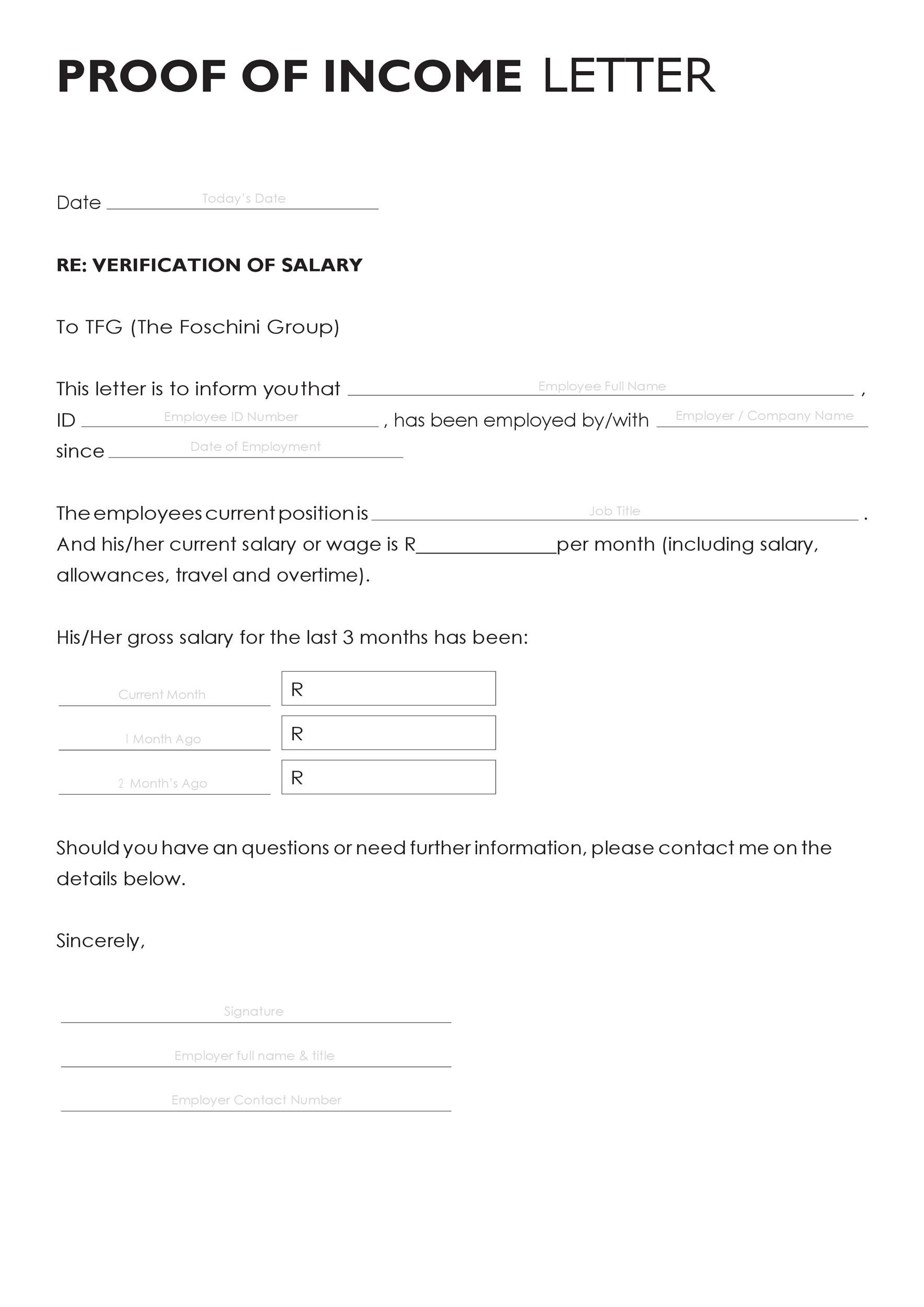

Free 3 Self Employment Sworn Statement Samples In Pdf Doc

Living Arrangements Trends Of 25 34 Years Old In The United States Oc R Dataisbeautiful

40 Income Verification Letter Samples Proof Of Income Letters

Coronavirus Business Support March 2020 360 Accounting Chesterfield

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

How To Avoid Debt Save Money While In College Experts Corner Applerouth

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

Mortgage Guide For The Self Employed Moneygeek Com

Self Employed Home Loans Explained Assurance Financial

The Mortgage Market Is Not Meeting The Needs Of Self Employed Workers Urban Institute

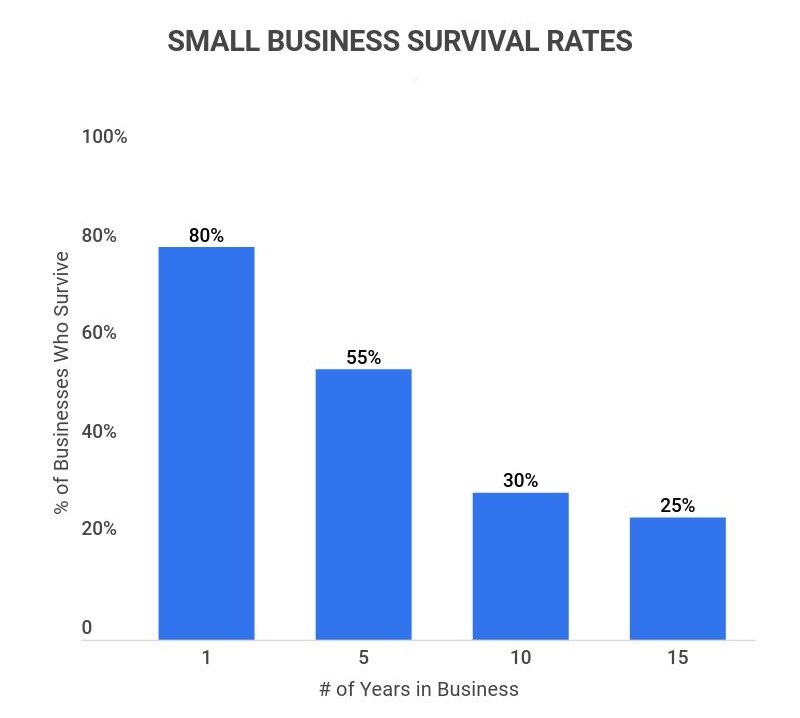

40 Successful Bootstrapped Startups Without Funding Eqvista

Loan And Mortgage Servicing Solutions Target Group

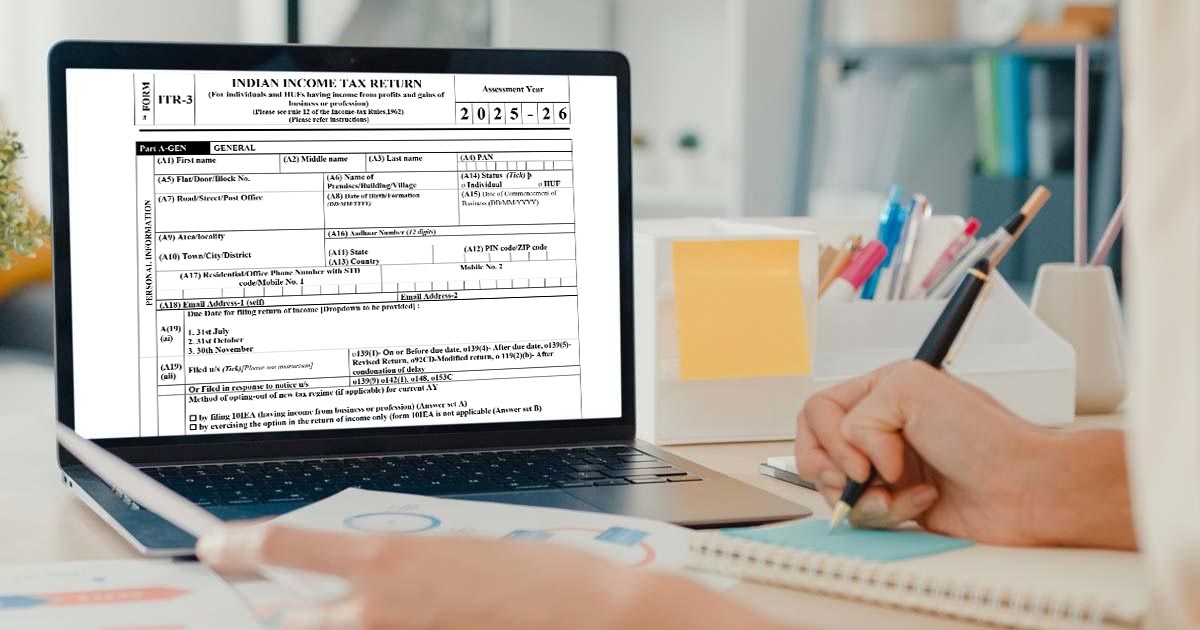

Step By Step Guide To File Itr 3 Online For Ay 2023 24 With Due Dates

How To Get A Mortgage When Self Employed

Getting A Mortgage When You Re Self Employed